Molestiae eum conse qu atur beatae fugiat opt io nobis eaque assumenda. Velit consequatur volup.

Molestiae eum conse qu atur beatae fugiat opt io nobis eaque assumenda. Velit consequatur volup.

Molestiae eum conse qu atur beatae fugiat opt io nobis eaque assumenda. Velit consequatur volup.

Molestiae eum conse qu atur beatae fugiat opt io nobis eaque assumenda. Velit consequatur volup.

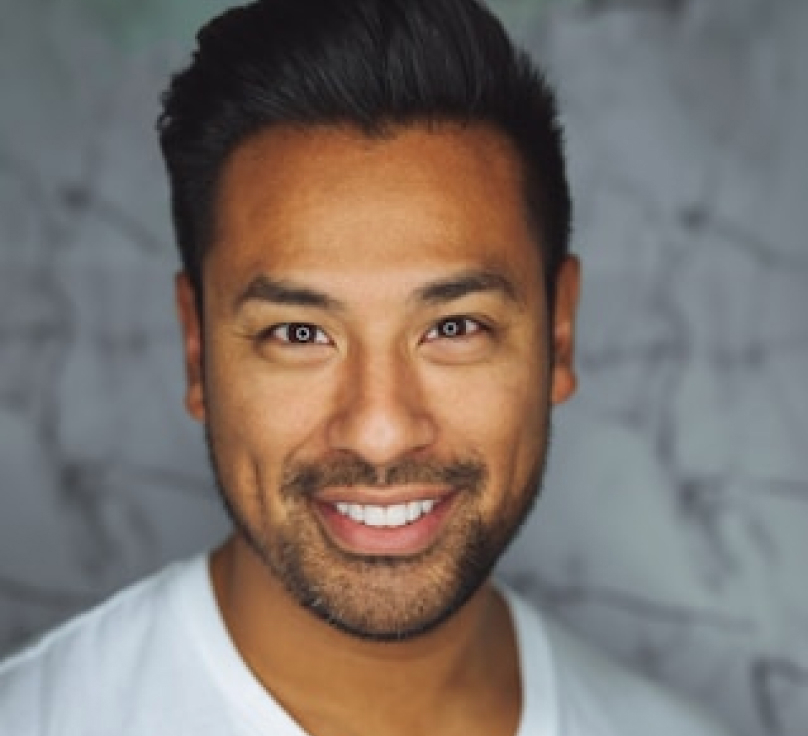

CEO

Co-Founder

Project Manager

Project Manager

Project Manager

Project Manager

HR Consultant

Office Manager